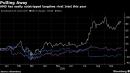

(Bloomberg) — Advanced Micro Devices Inc. is in advanced discussions to buy Xilinx Inc. in a takeover that could be valued at $30 billion, according to people familiar with the matter.The deal could come together as early as next week, though things remain in flux, the people said, asking not to be identified discussing a private deal. The Wall Street Journal first reported on the negotiations.A combination with Xilinx would give AMD Chief Executive Officer Lisa Su more of the pieces needed to break Intel Corp.’s stranglehold on the profitable market for data-center computer components. It would follow moves by rival Nvidia Corp., which bought Mellanox Technologies Ltd. and aims to use its pending acquisition of Arm Ltd. to grab more of that business.Acquiring Xilinx, which makes programmable chips for wireless networks, would also help AMD expand into a new market just as telecommunications carriers spend billions to build fifth-generation, or 5G, networks.Xilinx, based in San Jose, California, makes field programmable gate arrays, or FPGAs. That kind of chip is unique because its function can be altered by software, even after it’s been installed in a piece of machinery. Xilinx’s chips have historically been used in telecommunications equipment, but under CEO Victor Peng the company is expanding into products targeted at data centers — where FPGAs can be used to accelerate workloads such as artificial intelligence.Representatives for AMD and Xilinx declined to comment.Xilinx shares closed at $105.99 in New York on Thursday. That gives it a market capitalization of $25.9 billion, about a quarter of AMD’s value. Shares of Santa Clara, California-based AMD closed at $86.51. The stock has almost doubled this year.Under Su, who took the helm in 2014, AMD has surged back from the brink of failure. It’s made gains against longtime rival Intel in desktop computer processors and laptops. The company is also working to reverse its fortunes in the server business, where chips can cost as much as a small car. For years, Intel had relegated AMD to less than 1% of that market.AMD’s interest in Xilinx reflects the increasing demands of cloud-services providers such as Amazon.com Inc. and Alphabet Inc.’s Google. Those companies are spending heavily on new data centers to meet the surge in demand for computing power delivered via the internet. They’re also racing to enhance services, such as search with artificial intelligence software, and many companies are experimenting with building their own hardware to do so. That’s putting greater pressure on chip providers to advance their offerings.(Updates with background about AMD, share prices in eighth paragraph)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,