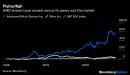

(Bloomberg Opinion) — It looks as if 2020’s chip merger mania isn’t going to stop anytime soon. We’ve already seen the $21 billion tie-up between Analog Devices Inc. and Maxim Integrated Products Inc., followed by Nvidia Corp.’s $40 billion planned takeover of Arm Ltd. Now comes word that Advanced Micro Devices Inc. is in advanced talks to buy Xilinx Inc. in a transaction that could value the target at $30 billion. The first two deals make decent sense; I am not so sure about this latest one.The semiconductor industry is undergoing a wave of consolidation as companies look to achieve greater market heft and offer customers a broader range of integrated products. The merger of Analog and Maxim unites the No. 2 and No. 3 players in the analog chip market, creating a more formidable competitor while offering opportunities for the combined company to cut costs. Nvidia — which is big in the market for graphics chips used in cloud computing, artificial intelligence and video games — sought Arm for its know-how in general-purpose processors, a core component it needs to offer integrated computing systems. An AMD-Xilinx transaction lacks these sort of obvious synergies or strategic rationales.First, the two companies couldn’t be more different. AMD is a leading maker of central-processing units (CPUs) and graphics processors, which are used for some of the hottest growth markets and aimed at both consumers and companies. In contrast, Xilinx makes specialized chips called FPGAs that can be reprogrammed and are primarily used for industrial and defense applications.While AMD has been on a tear, Xilinx has been struggling. AMD’s sales rose 26% in its June quarter from a year earlier; revenue at Xilinx revenue fell 14% in the same period. AMD’s shares were the No. 1 performers in the S&P 500 Index in each of the last two years and are up more than 80% again this year, while Xilinx stock has lagged. AMD has been thriving by offering better-performing and more power-efficient chips, winning more of the market from its main competitor Intel Corp., which has faltered on manufacturing delays. AMD advanced over Intel in every major CPU segment during the June quarter, according to Mercury Research, with its overall share of the CPU market rising 3.5 percentage points from the prior quarter to 18.3%.As a result of its chip technology advantages, AMD is likely just getting started and on the cusp of a multiyear growth opportunity in the key computer desktop and server chip markets. And that is why this deal is so perplexing. Why mess with a good thing and risk getting distracted? A $30 billion transaction would represent about a third of AMD’s roughly $100 billion stock valuation and likely require some sort of equity component. Why give up a significant portion of your market capitalization for Xilinx, which is not growing and in totally different markets? Perhaps AMD should revisit the strategy that made it so successful in the first place. In 2018, CEO Lisa Su told PC Mag that when she first took over AMD’s top role four years earlier, she decided it was important to focus the company on making high-performance computing chips (CPUs and graphics) and cutting back resources on everything else. Meanwhile, Intel chose to acquire many companies in disparate areas — including Xilinx’s main competitor Altera Corp. in 2015 — which may have played a role in distracting its management from focusing on its core products.AMD should consider that sometimes doing nothing is the best move and stick to the laser-focused strategy that is working.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Tae Kim is a Bloomberg Opinion columnist covering technology. He previously covered technology for Barron’s, following an earlier career as an equity analyst.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,