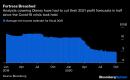

(Bloomberg Opinion) — There are no fireworks over Cinderella Castle these days, and yet investors remain captivated by Walt Disney Co. Are they caught up in fantasy?The whimsical palace overlooking Disney’s Magic Kingdom in Orlando, Florida, has long stood as a symbol of the company and its status as both a source of enchantment and an impenetrable fortress in the entertainment world. Like the castle, Disney is well built, stately and admired, and it’s surrounded by an ostensibly protective moat. But much has changed this year. Operating profit — normally driven by the company’s theme parks and cable-TV networks such as ESPN — plunged 98% in the three months through June 27 from a year earlier as the Covid-19 crisis took aim at every single one of Disney’s lines of business.Despite that, investors foresee happily ever after. They value shares of Disney at 44 times forward earnings estimates. That’s a 75% premium to the S&P 500 Index’s average earnings multiple. It’s also rich by Disney standards; the stock price has had an average multiple of just 20 over the last five years. Comcast Corp. at least has one stable business — broadband internet — but it’s left with a price-to-earnings ratio of only 16. Meanwhile, profit projections for Disney look like this:Translation: Investors are such firm believers in Disney’s prospects that they’re willing to pay now for 44 years worth of potential earnings. It’s simply remarkable considering all that Disney is up against. A company whose revenue is directly tied to packed public venues such as movie theaters, theme parks and sports arenas has been largely inoperable for much of the year. The planned expansion of its cruise-ship fleet has been put on pause. Movie and streaming projects also were halted as, for a time, were sports. It’s not clear what any of these revenue sources will look like after the pandemic, which may have lasting effects on society and consumer behavior. And Disney is facing all of this with new leadership. Even now, movie theaters don’t have enough releases or patrons to justify staying open. And while Disney World is back welcoming visitors (with crowd limits), the company said in August that it wasn’t seeing as much of a rebound as expected. A recent Morning Consult survey found that 42% of U.S. adults wouldn’t feel safe visiting an amusement park even six months from now. As California prevents Disneyland from reopening because of the lingering threat of the virus, Disney said it would let go 28,000 U.S. theme-park workers. The Disney+ app has proved popular in the meantime, and streaming is considered a bright spot for Disney — bright red if you’re talking financial statements, though. Analysts expect the streaming business to lose more than $2 billion in the new fiscal year that began last week. The company is set to report its latest quarterly results Nov. 12.Cinderella Castle may still be the perfect metaphor for Disney. To onlookers it’s a magnificent towering structure, but the castle was made to look grander than it actually is. At only 189 feet, it barely tops Spaceship Earth, the big sphere at Epcot. The Empire State Building in New York is seven times taller.Perhaps Disney’s future becomes a bit of an optical illusion, too: Can the company shrink methodically into a smaller version of its pre-Covid self while still earning similarly impressive profit margins and wielding the same influence as it did before? That’s difficult to answer, but it seems like a probable strategy. The retail industry is already trying this, embracing boutique storefronts over sprawling floor plans, because for them shrinking means survival.Disney investors can’t possibly be betting on a total return to normal, nor would a reasonable person expect that the economics of the streaming business could ever supplant Disney’s traditional profit powerhouses. But maybe there’s still a way for investors to get their fair- tale ending. This is Disney, after all. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Tara Lachapelle is a Bloomberg Opinion columnist covering the business of entertainment and telecommunications, as well as broader deals. She previously wrote an M&A column for Bloomberg News.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,