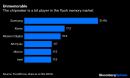

(Bloomberg Opinion) — Intel Corp. has stumbled lately. To right itself, the semiconductor giant needs to get back to basics and prioritize its main business. An exit from the memory industry would help that effort.On Monday, the Wall Street Journal reported that Intel is close to selling it memory-chip subsidiary to SK Hynix Inc. for about $10 billion, citing people familiar with matter. Despite large investments in flash memory, Intel has never been able to become a big player in these types of semiconductors, which are used in storage devices inside computer hard drives and consumer electronics. That’s a problem because in a commodity market such as memory, leadership and size are essential to generate profits over the long term. With no prospects for large gains on the horizon, Intel is smart to consider giving up on memory. First, the move can help the company’s bottom line. Earlier this month, Raymond James estimated Intel could boost its annual free cash flow by $2 billion if it left the memory business. Second, the prospects of this part of the chip industry aren’t very promising. That, analysts say, is because market leader Samsung is willingness to flood the market if necessary, without regard to maintaining its prices, to defend its leading position. Not a great situation for the other smaller players. Even Micron Technology Inc. CEO Sanjay Mehrotra hinted at those difficult industry dynamics during his earnings call last month. He noted the industry needs to reduce its factory investments if chipmakers wanted to improve the market’s profitability. This is a battle Intel doesn’t need to fight.But most importantly, Intel needs to focus on its primary business: central-processing unit (CPU) chips. Frankly, the company has gotten distracted with several needless acquisitions and forays into disparate markets such as security software, smartphone wireless chips and programmable FPGA chips. All those areas don’t matter if the company loses technical leadership in the CPU market. And after Intel revealed in July that another next-generation chip based on 7-nanometer manufacturing technology would be delayed, most analysts now believe Advanced Micro Devices Inc. has the prime position to make the fastest, best-performing processors for several years. A $10 billion deal isn’t going to fix all the problems of a $200 billion company. But every step toward a more focused Intel is a positive.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Tae Kim is a Bloomberg Opinion columnist covering technology. He previously covered technology for Barron’s, following an earlier career as an equity analyst.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,