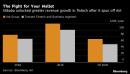

(Bloomberg) — Tencent Holdings Ltd. joined Alibaba Group Holding Ltd. and much of China’s internet sector in a $290 billion selloff after Beijing signaled its strongest intentions yet to rein in Big Tech. Yet the social media and gaming giant is in some ways better shielded than its peers from any potential crackdown.Executives unfurling earnings Thursday will seek to reinforce perceptions Tencent isn’t in the same boat as fintech giant Ant Group Co., the Alibaba affiliate forced to call off what would’ve been the world’s largest initial public offering after Beijing tightened its control of online lending. Citigroup and JPMorgan were among brokerages that recommended investors buy Tencent during the sell-off.For years, Tencent had been the more sedate runner-up to Jack Ma’s splashy Ant in the burgeoning field of internet finance, focusing more on bread-and-butter mobile payments via WeChat while ensuring enough capital to back up a smaller consumer loan book. In its main business of gaming, the company endured a 2018 crackdown that sent the world’s largest mobile games empire into a tailspin and has since put stricter measures in place to curb addiction among youths. And while WeChat is the go-to daily app for a billion-plus Chinese, regulators may take into account how the company has yet to fully monetize the service’s potential for e-commerce, finance and other adjacent businesses, according to analysts.“Tencent will be better off, because its core businesses from social advertising to video games don’t have much to do with the real economy and people’s livelihood, compared to e-commerce and financial platforms,” said Ke Yan, a Singapore-based analyst with DZT Research.Read more: China Clampdown on Big Tech Puts More Billionaires on NoticeChina’s antitrust watchdog on Tuesday laid out guidelines for the first time to root out monopolistic practices among local tech leaders, banning their online platforms from colluding on sharing sensitive consumer data, forming alliances that squeeze out smaller rivals and subsidizing services at below cost to eliminate competitors. While the proposed new rules aren’t targeting e-commerce operators exclusively, anti-competitive behavior such as forced exclusivity and biased algorithm-based pricing are more common in that arena.Shares of Tencent gained 5.4% in Hong Kong trading Thursday, snapping back from a two-day 11% loss. Alibaba was up 3%, after having slumped 14% the previous two days as investors scrambled to assess the fallout from China’s attempt to rein in its most powerful private-sector firms.After years of granting the booming internet sector mostly free rein to grow, Beijing is now stepping up oversight of the two Internet giants and its peers, as it does with businesses that dominate other parts of the world’s second-largest economy. The antitrust regulations landed about a week after new restrictions on online consumer loans that triggered the shock suspension of Ant’s $35 billion IPO, and overshadowed Alibaba’s record-setting Singles’ Day shopping bonanza. On Wednesday, China’s banking regulator also vowed to escalate its fintech clampdown, saying online firms like Ant should be subject to the same supervision and risk management requirements as traditional banks.Tencent’s fintech business — valued at anywhere from $200 billion to $300 billion before Ant’s IPO derailment — is the closest competitor to the Alibaba affiliate, though it still lags in some arenas. Together with cloud computing, the company’s fintech and business services segment is its fastest-growing division, making almost $15 billion, or a quarter of total revenue, in 2019. The bulk of that is generated from commercial payments facilitated by the WeChat super-app, where a billion Chinese schmooze, shop, and share cabs. Also through WeChat, Tencent touts financial services that are similar to Ant’s but on a far smaller scale. That’s due in part to a mix of factors, from Ant’s first-mover advantage to its incorporation as a standalone company and a better grasp of consumer data via e-commerce transactions.“Tencent has the luxury to wait and see and let Ant be the trailblazer and learn from their mistakes,” said Bloomberg Intelligence analyst Vey-Sern Ling. “Once Ant has jumped over all the hurdles, it’s not too late for Tencent to follow, since they have the users and the payment system.”For now, Tencent can still count on its gaming cash cows, while global macro uncertainty and competition with ByteDance Ltd. may continue to depress advertising. Revenue for Tencent is expected to grow a steady 27% in the September quarter, while analysts on average forecast net income to rise 48% from a year earlier. It benefited from a resurgence in online services during the Covid-19 pandemic, and has charted a line-up of new titles for the next year to shore up mainstay franchises Peacekeeper Elite and Honor of Kings. In October, Tencent’s Riot Games unit started testing League of Legends’ much anticipated mobile version in Asia.On top of dominating e-commerce and gaming, Alibaba and Tencent are also key backers of leaders in other swaths of China’s internet from food-delivering platform Meituan to car-hailing giant Didi Chuxing. They’ve together invested billions of dollars in hundreds of up-and-coming mobile and internet companies. Tencent is leading a merger of DouYu International Holdings Ltd. with Huya Inc. to create a Chinese game streaming behemoth with a $10 billion market value.That kingmaker status may take a blow from the new antitrust regulations, which now scrutinize mergers and acquisitions by companies that operate a so-called Variable Interest Entity — a vehicle through which virtually every major Chinese internet firm lists overseas.But beyond the scale of the two companies’ operations and outsized influence in the modern Chinese economy, Tencent has one comparative advantage over its larger rival.In the lead up to Ant’s IPO halt, Alibaba’s Ma slammed China’s financial rules for stifling innovation, labeling old-guard banks “pawn shops” in a high-profile conference attended by senior Chinese officials. Tencent has no need to worry about similar key-person risks: Its own spotlight-shy founder Pony Ma has been a no-show in the public for more than a year due to health reasons, while other major executives have avoided ruffling Beijing’s feathers.“In our various fintech businesses, we position ourselves as a collaborator and enabler of the industry and with other partners, rather than a disrupter in the market,” Tencent President Martin Lau said at the Hong Kong FinTech Week event earlier this month. In the taped recording made before China unveiled the new rules on online banking, he added that the company works very closely with regulators and has “strong respect for risk management.”(Updates share price in sixth paragraph)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,