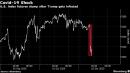

(Bloomberg) — U.S. equity index futures fell after President Donald Trump announced that he and First Lady Melania Trump had tested positive for Covid-19, sparking a pull-back in riskier assets and sending the VIX higher.December contracts on the S&P 500 Index were trading 1.2% lower as of 9:15 a.m. in London after falling as much as 2% earlier. Futures on the Dow Jones Industrial Average were down 1.2% and those on the Nasdaq 100 Index down 1.8%. The VIX Index rose to 29, but remained below peaks seen last week. The Stoxx Europe 600 fell as much as 1.2% shortly after the open, before bouncing off lows, still down 0.4%.In a memo released early Friday morning in the U.S., Trump’s physician said that the president and first lady plan to remain at the White House “during their convalescence” and that the medical unit would “maintain a vigilant watch.”READ: Market Watchers Warn of Deeper Selloff as Trump Tests Positive“We’re struggling to get our head around it because such things are clearly not in the manual of investment management,” said Gary Dugan, chief executive officer at Global CIO Office. “He could be isolated for two weeks, so that may mean he calls an invalid election.”Judd Deere, a White House spokesman, said contact tracing for Trump and Melania Trump was being carried out and “the appropriate notifications and recommendations will be made.”S&P 500 contracts had seen mild weakness earlier after the House of Representatives passed a $2.2 trillion Democrat-only fiscal stimulus package that Republicans reject. Next up comes the monthly U.S. payrolls data later Friday.“With Republicans still firmly opposed to the Democrats’ plans, any political lockdown due to Trump’s diagnosis — and all the unmasked people he has come in contact with — could prove to be fatal to the progress of the much-needed stimulus package,” said Connor Campbell, a financial analyst at Spreadex.Global equities have struggled since reaching a peak in September, leaving investors looking for the next market catalysts amid the continuing fallout from the pandemic. Thousands of job cuts this week showed how firms are still wrestling with readjustments needed to survive in the pandemic era as virus cases continue to climb.“Investors should hedge themselves against S&P. Most people may still be having their hedges on, given what happened in March,” said Justin Tang, the head of Asian research at United First Partners in Singapore. “A lot depends on what happens in the next seven days. If Trump goes to ICU, it is going to be a big problem, but if he is asymptomatic, that volatility may get contained.”(Updates prices, adds VIX Index)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,